Captive solutions

Captive solutions

An innovative strategy to provide better benefits at lower rates, while allowing employers to reinvest the proceeds for well-being benefits programs important to employees today.

Reimagine voluntary benefits with a captive

We are here to help you leverage captives to provide competitive employee benefits at a controlled cost. The captive model is a low risk way to support employees with reduced volatility while allowing you to earn a profit when the captives outperform expectations. Learn more about how you can use captives as an alternative risk management tool for your employee benefits.

Which captive solution is right for you?

Are you a Risk Manager looking for solutions?

Are you an employer who already has a captive? Learn more about our single parent captive solutions.

Are you an HR Manager looking for solutions?

Are you an employer with more than 1,000 employees in need of captive solutions? Learn more about our group captive solutions.

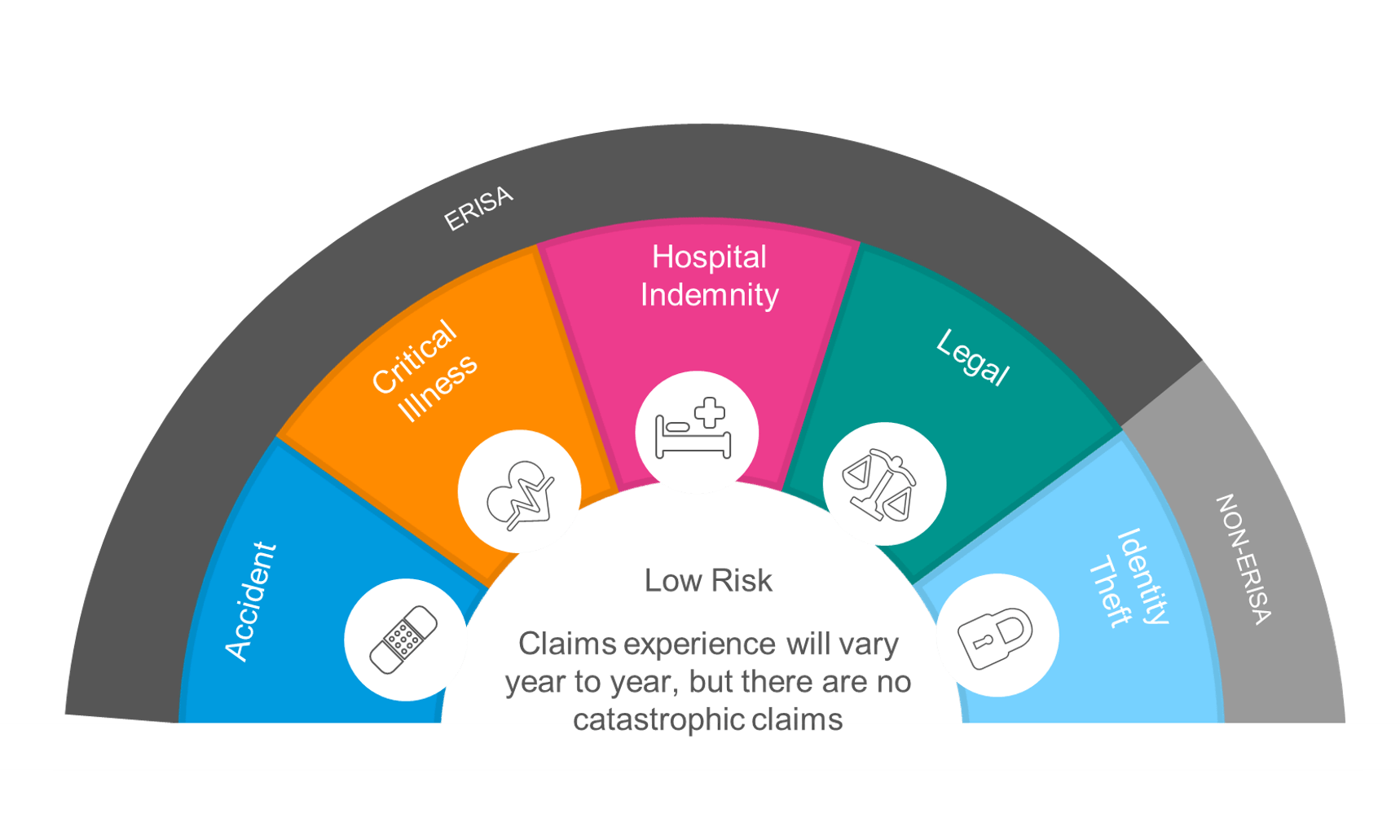

Voluntary benefits available product lines

Our leadership team

Our leaders and consultants are here to help you grow and diversify your captive.

Stephanie Lefkowski

Senior Financial Leader, Marsh McLennan Agency

John Forde

Consultant, Marsh McLennan Agency

Krystie Dascoli

Voluntary Benefits Practice Leader, Marsh McLennan Agency

Arthur Koritzinsky

Captive Advisory Leader, Marsh Captive Solutions

Insights and news

The latest industry news, insights and thought leadership.